Salesforce (NYSE: CRM) remains one of the most influential technology companies in the world. As a global leader in Customer Relationship Management (CRM) software, the company has consistently evolved through cloud computing, artificial intelligence (AI), automation, and enterprise solutions.

In 2026, investors are asking a critical question: Is CRM stock still a smart investment right now? This detailed analysis explores Salesforce’s business model, financial performance, growth drivers, risks, and long-term outlook.

Company Overview

Founded in 1999, Salesforce transformed the software industry with its cloud-based CRM platform. Today, it provides a wide range of enterprise solutions including Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Slack, Data Cloud, and AI-powered tools like Einstein AI.

Salesforce serves businesses of all sizes, from startups to Fortune 500 companies, making it deeply integrated into global enterprise infrastructure.

Salesforce Financial Performance 2026 Outlook

Although stock performance fluctuates based on market conditions, Salesforce has demonstrated several strong financial characteristics:

- Consistent revenue growth

- Strong recurring subscription-based income

- Expanding operating margins

- Share buyback programs

- Improved cost efficiency after restructuring

The company’s stronger focus on profitability and disciplined spending has improved investor confidence.

Key Growth Drivers for CRM Stock in 2026

AI Integration and Automation

Salesforce has aggressively integrated AI into its ecosystem. AI-powered tools help businesses automate customer service, marketing, and sales processes, increasing productivity and platform demand. AI remains one of the strongest catalysts for future CRM stock growth.

Enterprise Digital Transformation

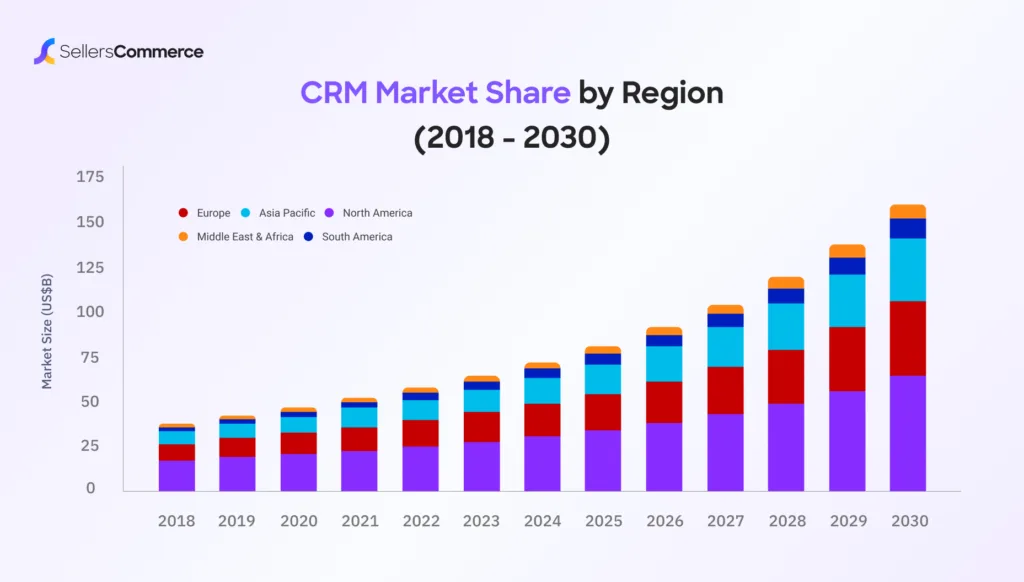

Global companies continue shifting toward cloud infrastructure. Salesforce directly benefits from this long-term digital transformation trend.

Strong Ecosystem and Customer Retention

Salesforce maintains high customer retention due to its multi-product ecosystem, deep integrations, and high switching costs. This creates predictable and recurring revenue.

Expansion into Data and Analytics

Businesses rely heavily on real-time data insights. Salesforce’s growing focus on analytics and data platforms strengthens its competitive advantage.

CRM Stock Strengths and Weaknesses

| Strengths | Weaknesses |

|---|---|

| Market leader in CRM software | Premium valuation compared to peers |

| Strong recurring revenue model | Competitive pressure from Microsoft and others |

| Expanding AI integration | Enterprise spending can slow during recession |

| Improving profit margins | Sensitive to corporate IT budgets |

Competitive Landscape

Salesforce competes with major players such as Microsoft Dynamics 365, Oracle, SAP, and HubSpot. Despite strong competition, Salesforce continues to hold leadership due to its global presence, product depth, and brand strength.

Risks to Consider Before Investing

Investors should consider potential risks including economic slowdowns affecting enterprise budgets, increasing AI competition, regulatory challenges, and overall tech market volatility. Technology stocks can also be sensitive to interest rate changes and macroeconomic conditions.

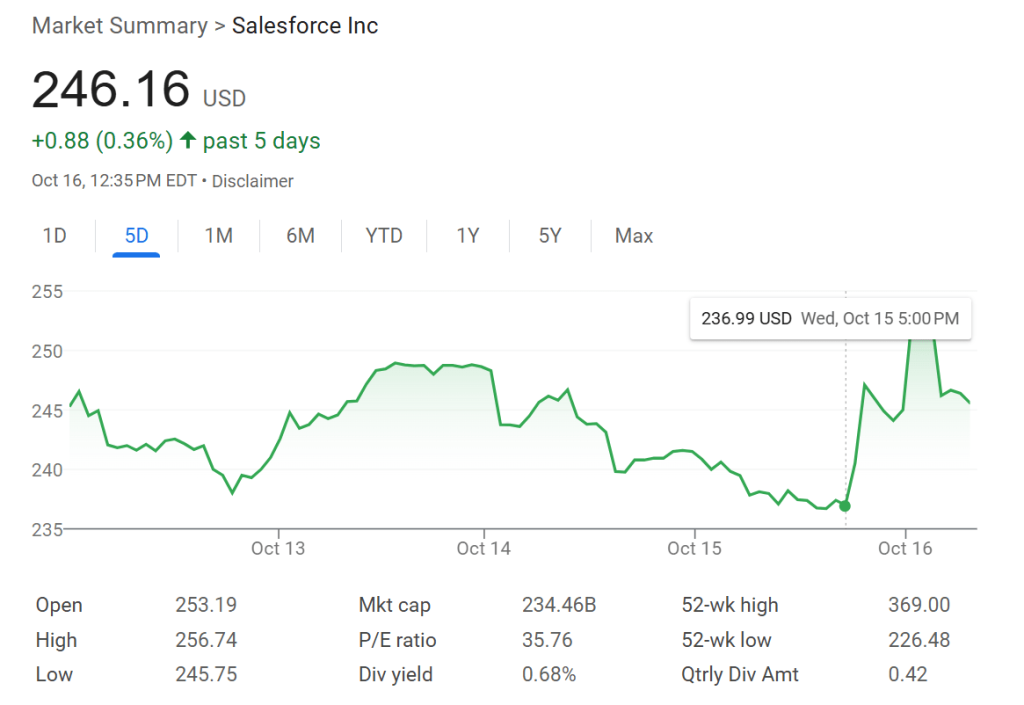

Is CRM Stock Overvalued or Fairly Priced?

Valuation depends on revenue growth, profit margins, free cash flow, and future AI monetization potential. If Salesforce continues expanding margins and successfully monetizing AI solutions, current valuations may remain justified for long-term investors.

Short-term volatility, however, is always possible in the tech sector.

Long-Term Investment Outlook 2026–2030

Salesforce offers strong brand dominance, a recurring revenue model, AI-driven innovation, and an expanding enterprise ecosystem. If the company maintains operational efficiency and product innovation, CRM stock may continue to perform well over the long term.

Final Verdict

CRM stock appears to be a solid long-term investment candidate for investors who believe in AI-driven enterprise growth and prefer subscription-based technology companies. However, it may not be suitable for short-term speculative trading due to potential volatility.

Investors should carefully evaluate their financial goals and risk tolerance before making investment decisions.

#CRMStock #Salesforce #SalesforceStock #CRMAnalysis #StockMarket2026 #TechStocks #NYSE #StockMarketNews #StockAnalysis #Investing #LongTermInvestment #GrowthStocks #AIStocks #CloudComputing #EnterpriseSoftware #StockMarketInvesting #MarketTrends #FinancialAnalysis #WealthBuilding #InvestmentStrategy #Carrerbook #Anslation